As part of Georgia Tech’s commitment to institutional compliance and adherence to government issued travel-related policies, Procurement and Business Services is sharing several updates to essential travel-related policies and procedures as well as clarifying common procedures to help ensure travelers understand how to complete their expense reports accurately and in a timely manner.

As part of Georgia Tech’s commitment to institutional compliance and adherence to government issued travel-related policies, Procurement and Business Services is sharing several updates to essential travel-related policies and procedures as well as clarifying common procedures to help ensure travelers understand how to complete their expense reports accurately and in a timely manner. Travelers who do not comply with these requirements will have their expense report returned, delaying reimbursement.

Expense memo and business reason now mandatory effective July 1

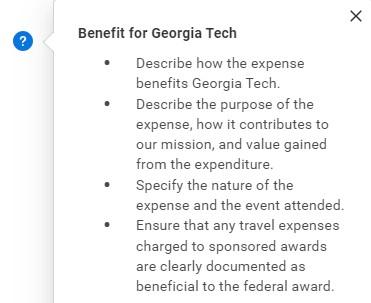

The memo field in the header of the expense report must now provide the purpose of the expense request, describing how it benefits Georgia Tech.

Note the who, when, where, what and why (the benefit to Georgia Tech).

Make sure that the travel dates on the expense report match the travel dates of the business travel on the spend authorization.

See exhibit A below for an example of how to complete the memo field.

The memo field for the ground transportation expense item must also provide the purpose of the ground transportation. Examples include airport to hotel, hotel to customer’s office for meeting, etc.

Travelers may be reimbursed for the mileage incurred from one point of departure to travel destinations..

If a traveler departs from their normal work location (headquarters), mileage is calculated from normal work location (headquarters) to the destination point on regular workdays. If a traveler departs from their residence during regular workdays, mileage is calculated from the residence to the destination point, with a reduction for normal (i.e. residence to headquarters) one-way commuting miles.

If a traveler returns to normal work location (headquarters), mileage is calculated based on the distance to such normal work location (headquarters). If a traveler returns to their residence, mileage is calculated based on the distance to the residence, with a reduction for normal (i.e. headquarters to residence) one-way commuting miles.

While the policy-driven procedures below are not new, there will be no exceptions beginning July 1, 2024.

Spend Authorizations:

- Spend authorizations must be fully approved before the start of travel. If authorization is granted on or after the first day of travel, justification is required in the header of the spend authorization.

- Once travel dates have been confirmed and fully approved, per state policy, "all flights should be booked at least 14 days, but no more than 30 days in advance, when practical. Flights booked within 30 days of travel help manage agency cash flow and reduce the risk of potential change fees and administrative costs related to any subsequent change in travel plans." The policy adds, “Flights booked with less than 14 days advanced purchase are more expensive and require that a written explanation for the booking delay be provided to the approver." Approved explanation/justification must be attached to the expense report.

Expense Reimbursement Submission Timeliness:

- Travelers should submit all expenses for reimbursement and reconciliation within 10 days of the completion of the trip or event but no later than 45 calendar days.

- Expenses submitted more than 60 calendar days after completion of the trip or event, if reimbursed, may be considered taxable income. See IRS publication 5137 for further details.

- Expense reports submitted in excess of one calendar year after the date of the trip or event may not be reimbursed.

Receipts and Supporting Documentation:

- Attach the conference agenda/schedule/itinerary/program to the expense report when the Expense Item: Conference/Seminar is selected. Links to the conference websites and web pages are not acceptable. Please make sure to upload the copies as a .pdf attachment.

- All single expenditures of $25 or greater require receipts. Proof of payment should reflect the form of payment (i.e. paid by cash, check, or credit card).

- Receipts for meals related to per diem are not required.

- If the receipt is for a group meal, the business purpose for the meal and list of participants, if less than 15, is required. Additional requirements apply based on the funding used.

Recommendation for non-reimbursable conference registration: If a conference registration is paid via supplier invoice request (SIR) or P-Card and is not reimbursable to the traveler, it is recommended that the employee include the expense and clearly identify the item as a "personal expense" on the expense report. This helps ensure all travel-related expenses are accounted for.

Conversion Rates for Expense Reports:

- Expense reports in Workday can convert charges from foreign currency to U.S. dollars.

- If a foreign currency expense item is claimed in U.S. dollars, submit documentation that supports the currency exchange rate matching the date the expense was incurred.

Expense Reporting and Dates:

- Each expense line should be reported individually.

- Expense dates must match the date the expense was incurred. If multiple payments were incurred for the same expense item, use the date the final payment was incurred.

- Lodging expense, including any applicable deposits and final billing, must reflect the check-out date.

- Airfare expenses must reflect the return flight date. If credits or exchanges are used, enter the return date of the flight and provide all supporting documentation.

- Toll fees should reflect the date the toll was incurred within the travel period.

- Conference registration should reflect the last day of the conference (related to the business trip). If the traveler requests reimbursement for the conference fee before departure, create a spend authorization (estimating all other travel-related expenses) if applicable and expense the conference fee linking the expense report to the appropriate spend authorization. Do NOT mark the expense report as final.

When entering an expense report, there is helpful guidance text next to some fields in Workday (click on the question mark) to assist you in completing the expense reports (see Exhibit B for an example).

If you have any questions or need clarification on any of these travel-related requirements, reach out via ServiceNow or to the Travel and Expense Manager Xinia Richards.

Additional Images